When you're starting a business, it is often best to begin while you're still working a full-time job in my opinion. This way you can get everything setup properly and part of that is both savings and lines of personal credit.

Build Your Credit and Expand Your Funding

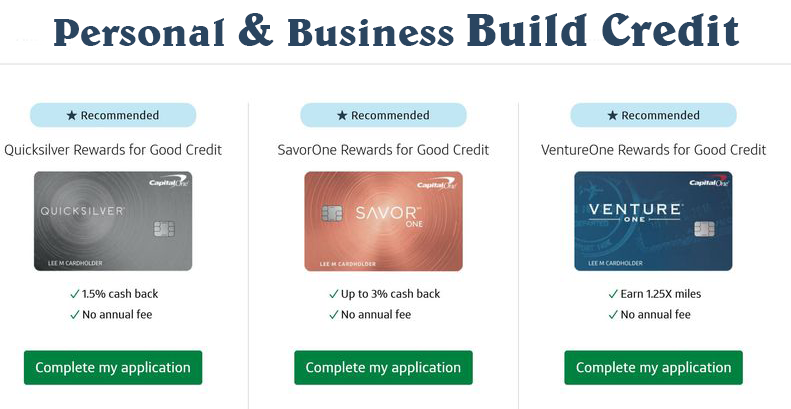

If you haven't left your full-time job yet—great! It's easier to plan ahead than to be caught off guard. As you step into self-employment, securing credit quickly can be challenging, so it's wise to make big purchases (like a car or a home) before leaving your job. Additionally, maintaining personal lines of credit is critical. Keeping personal and business finances separate will make tax time far less frustrating.

Pro Tip: If your credit score is decent, expand your available credit now. Also, open a savings account for emergency funds, which will help you cover bills when cash flow is tight.

First Steps in Starting a Business

Choosing a name for your business is one of the first and most important steps. Since your business may evolve, consider using a name that isn't tied to a specific industry. For example, if you're selling widgets, don't call it "Widget Control Enterprises." Something neutral like W.C.E. LLC may be the better long-term choice.

Need help finding a name? Try browsing ExpiredDomains.net or domain registrars like GoDaddy to discover available and appealing options.

Selecting a Business Structure

Choose an organizational structure like an LLC, Corporation, or S-Corp. Most states allow you to file online. If you're starting a business with a partner, don't skip an operating agreement—it's vital. Additionally, consider a life insurance policy that pays out to the business, ensuring the company can buy out a deceased partner's share.

Apply for Your EIN

You'll need an Employer Identification Number (EIN) to open a business bank account. The good news? It's free through the IRS:

Apply for Your EIN Here

Open a Business Bank Account

Once you have your EIN and incorporation documents, open a business bank account. Consider using at least one nationally recognized bank such as Bank of America, PNC, or Chase. While there are great online options with helpful tools, establishing credibility early with a well-known bank can go a long way.

Generate Personal Capital

One benefit of using a neutral business name is flexibility and if you pivot on your concept it won't lock you into one thing. To build capital you can offer freelance services on sites like Fiverr, Upwork, sell unneeded items on eBay, or even drive for Lyft.

These gig jobs can generate capital through sweat equity. Even if you're still employed full-time, these side hustles build revenue for your business and develop time management skills which is an essential trait for business owners.

Watch Market Trends

Understanding long-term trends (5, 10, 20 years out) will help you position your business for success. For example, during times of high interest rates, homeowners often renovate instead of buying new homes—boosting demand for home improvement services. Identifying such trends lets you align your services or even support industries positioned to grow.

Get a Business Phone Number

A professional phone number is just as important as a website. Services like Optima Ignite offer solopreneur packages for modern cloud-based phone systems. You can also explore over 200 cloud phone system options through MyProDealer.